- home

- Accountant & Tax Agent in Campsie

Best Accountant and Tax Agent in Campsie NSW

Empowering Financial Prosperity through Expert Accounting, Tax, and Business Advisory Services in Campsie

One of the key features of the Number solutions is their experienced and certified team of professionals.

The ability of the Number solutions is to provide customized solutions for each client's unique business needs.

BEST TAX SERVICES

Accountant, tax agent and business advisory in Campsie

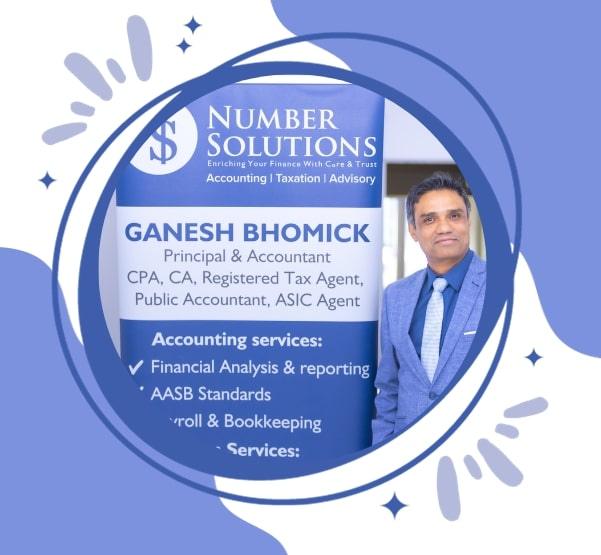

At Number Solutions Tax & Accounting, we take immense pride in being your trusted partners in the world of finance. Our mission is simple: to deliver excellence in tax, accounting, and business advisory services tailored to meet your unique needs in Campsie. As a Certified Public Accountant (CPA) practice, we go the extra mile to truly understand our clients and the challenges they face in their businesses.

Our commitment goes beyond numbers; we specialize in business formation, registration, compliance, and strategic advisory services. Whether you’re a business owner or an individual, our dedicated team is poised to deliver professionalism and expertise tailored to your unique requirements.

Join us on the path to financial accomplishment – the Number Solutions way.

❓ Are You Struggling with Taxes and Accounting in the Campsie, NSW area?

How a Professional Accountant Can Help You in Campsie

Navigating the financial intricacies of running a business in Campsie requires more than just numbers – it demands a strategic approach that a professional accountant brings to the table. At Number Solutions, we understand the multifaceted challenges that businesses face, and our team of expert accountants is dedicated to providing invaluable assistance tailored to your needs.

Expert Financial Insight: A professional accountant offers a keen understanding of financial trends, enabling them to provide insightful recommendations for your business. Whether you’re making investment decisions, considering expansion, or assessing profitability, their expert insights guide you towards informed choices that drive growth.

Strategic Tax Planning: Taxation is a significant aspect of business operations, and a professional accountant excels in developing effective tax strategies. They ensure your business takes advantage of available deductions, credits, and incentives while staying compliant with tax regulations, optimizing your tax liabilities.

Accurate Financial Records: A professional accountant ensures your financial records are accurate, organized, and up-to-date. This not only facilitates smooth day-to-day operations but also forms the foundation for sound financial decision-making and future planning.

Enhanced Financial Efficiency: Efficient financial management is crucial for business success. A professional accountant streamlines your financial processes, identifies cost-saving opportunities, and helps you allocate resources more effectively, contributing to improved overall efficiency.

Business Growth Guidance: As your business evolves, a professional accountant provides valuable insights into financial performance, helping you identify growth opportunities and potential areas for improvement. Their expert advice aids in crafting strategic plans that align with your business goals.

Regulatory Compliance: Staying compliant with regulatory requirements is paramount. A professional accountant keeps track of changing regulations and ensures that your business adheres to them, mitigating the risk of penalties or legal complications.

In the dynamic business landscape of Campsie, a professional accountant serves as a trusted partner, offering expertise that extends beyond numbers. At Number Solutions, we take pride in being your dedicated ally in achieving financial success. Our professional accountants are committed to providing meticulous attention to detail, strategic guidance, and comprehensive financial support to drive your business towards prosperity. Contact us today to explore how our services can benefit your business in Campsie.

Our Services

The importance of accounting in business is undeniable. Proper accounting practices are essential for keeping the business on track …

A tax consultant is a tax advisor who is an expert in tax planning, tax law, and compliance. Tax consultants are current about …

Self-managed Super Fund

A Self-Managed Super Fund is a super private fund that you manage yourself. SMSFs give their members control, flexibility…

Business Formation, Registration And Compliance

Starting a business can be overwhelming. From coming up with a business plan…

Business Advisory

It takes careful consideration and vigorous strategising to set up and run a business efficiently.

What We Do for Individuals

1. Personal Tax Returns: Our skilled tax accountants in Campsie ensure the accurate preparation and timely filing of your personal tax returns, minimizing tax liabilities and maximizing eligible deductions.

2. Personal Tax Disputes with ATO and Investigations: Facing a tax dispute with the ATO? Count on us to guide you through the intricate process, working towards fair resolutions. We also handle tax investigations, ensuring compliance with tax laws.

3. Individuals Property Tax Planning and Advice: Navigate property tax complexities with confidence. Our Campsie tax experts offer specialized advice on property-related taxes, helping you make informed decisions regarding investments and rental income.

For Sole Traders and Businesses

1. Tax Planning Services: Our expert tax planning services help you navigate the complexities of taxation, ensuring compliance and optimizing your tax strategies for maximum benefit.

2. Payroll and PAYE Services: Efficiently manage your payroll and PAYE obligations with our reliable services, ensuring accurate calculations and timely submissions.

3. ABN Registration, Business Set-Up: Starting a new business? We assist in ABN registration and guide you through the process of setting up your business efficiently.

4. Business Property Tax Planning and Advice: For business owners with property holdings, our specialists offer strategic tax planning and advice to optimize property-related tax strategies.

5. GST Lodgement: Stay compliant with GST regulations through our expert guidance and streamlined lodgement services.

6. Business Plans: Craft effective business plans that outline your goals and strategies for success with our professional assistance.

7. Business Growth Strategies and Planning Advice: Fuel your business’s growth with tailored strategies and expert advice to help you achieve your expansion goals.

8. Business Health Check: Evaluate the health of your business with our comprehensive assessment, identifying areas for improvement and growth.

9. Business Valuations Accurately assess the value of your business with our valuation services, essential for decision-making and potential transactions.

10. Independent Business Reviews and Appraisals Gain valuable insights into your business’s performance through our objective reviews and appraisals.

11. Bookkeeping Maintain accurate financial records and bookkeeping with our efficient and meticulous services.

Benefits of Choose Us as Your Tax Accountant

With Number Solutions Tax & Accounting your business growth is guaranteed because value-centred solution helps you to grow your business to the highest levels of profitability. Trust us to navigate the complexities of financial management while ensuring compliance and maximizing your financial potential.

- We create value and make a real difference to your business using our extensive industry knowledge and experience

- We listen and work with your partnership to provide the most effective solutions for your business

- We genuinely care about your business

- We work with you to increase your profit at the affordable price

- We maintain high-level constancy in our service so that you business is operating well

We Guarantee

- We will provide holistic financial service

- We help you beyond your expectation

- We will bring the positive result

- We will manage the things in a more simplistic way

- With care, we will ensure you are not wasting your time and money

Our values, Your growth

- Care

- Respect

- Holistic approach

- Partnership

- Trust

- Cutting edge solutions

Experience our exceptional accounting, taxation and business advisory services across Liverpool, Bankstown, Canterbury, Camden, Campbelltown, Fairfield, and throughout South West Sydney. Let us help you unlock your financial success with Number Solutions today.

Feel free to reach out to us through our website or give us a call at (02 9174 5327) at any time for any further queries you may have. We’re here to assist you.

Our Commitment to Excellence

At Number Solutions Tax & Accounting, we’re more than just accountants; we’re your financial partners. We’re dedicated to delivering value-centered solutions to small and medium-sized enterprises, not-for-profit organizations, and businesses in various sectors. Our founder, Ganesh Bhomick, brings over 15 years of experience, including serving the not-for-profit and trust accounting sectors.

For high-quality, personalized financial advice that can take your business to the next level, please don’t hesitate to contact us. Your financial success is our top priority, and we’re here to make it happen.

Trust Number Solutions Tax & Accounting for a brighter financial future in Campsie, NSW.

FAQ

Q. Can an Accountant help with tax planning and preparation?

Ans: Yes, Accountants are experts in tax matters and can assist with tax planning to minimize liabilities, as well as prepare and file tax returns for individuals and businesses.

Q. Do I need an Accountant if I use accounting software?

Ans: While accounting software is helpful, an Accountant can offer expertise, strategic advice, and ensure accurate financial reporting and compliance.

Q. Can an Accountant in Campsie help with personal finance management?

Ans: Yes, Accountants can provide personal financial planning services, including budgeting, investment advice, retirement planning, and estate planning.

Q. When should I hire an Accountant in Campsie for my business?

Ans: It’s advisable to engage an Accountant as early as possible to establish good financial practices. For businesses, this often means before you start operations or during the startup phase.

Q. How do I choose the right Accountant in Campsie?

Ans: Consider their qualifications, experience, and specialties. Look for recommendations, reviews, and ensure they are registered with relevant professional bodies.

Q. Can tax returns be lodged over the phone?

Ans: Yes, we offer the convenience of lodging tax returns over the phone, provided you have all the necessary documents ready. Call us at (02) 9174 5327

Q. Do you offer tax return services for international students?

Ans: Yes, we extend our tax return services to both domestic and overseas students employed in Australia.

Q. Do I need to schedule an appointment for your services?

Ans: It is advisable to arrange a pre-booked consultation session. Feel free to contact one of our amiable tax agents at 02 9174 5327.

Q. I operate a retail business outside of South West Sydney. Can I avail tax consultation services?

Ans: Absolutely, we provide complimentary phone consultations, even if you’re unable to visit our Campsie office.

Feel free to reach out to us for any more queries you may have. We are here to assist you.

Q. How Much Do Accountants Charge per Hour in Australia?

Ans: On average, the hourly rates for personal tax services in Australia are approximately $30-$40 in New South Wales. In various other states, the average costs usually range from $45 to $80 per hour.

Please be aware that these figures serve as general estimates and can vary based on location, the complexity of services required, and the specific accounting firm you choose to work with.

Q. I am a self-employed individual with an ABN. Do you handle tax returns and BAS for businesses?

Ans: Certainly, our comprehensive taxation services cater to both businesses and individuals, including self-employed individuals with an ABN.