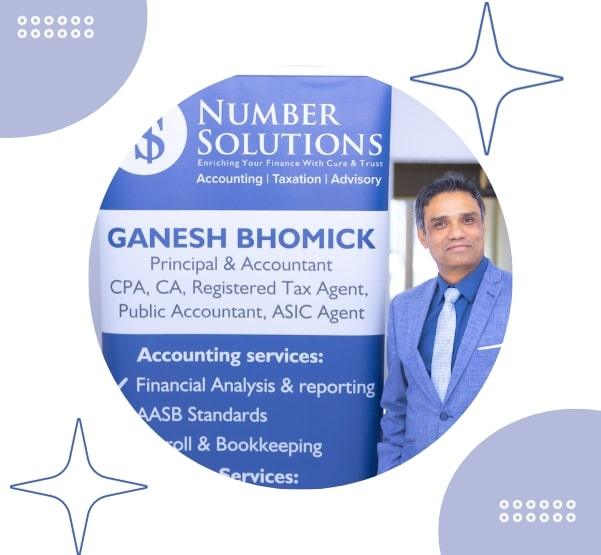

One of the key features of the Number solutions is their experienced and certified team of professionals.

The ability of the Number solutions is to provide customized solutions for each client's unique business needs.

BEST TAX SERVICES

Best Sole Trader Accountant

At Number Solutions, we specialise in providing top-notch accounting services tailored for sole traders. We understand that as a sole trader, you need more than just basic bookkeeping—you need a trusted partner who truly understands your business. Our mission is to deliver exceptional accounting, tax, and financial services that support your unique needs.

We go beyond number-crunching by offering practical advice and strategies that help your business thrive. From tax compliance to financial planning, our experienced team is dedicated to your success, providing clear communication without the jargon.

Choose Number Solutions for reliable and personalised accounting services designed specifically for sole traders.

Are you struggling with your sole trader accounting tasks?

Responsive and Reliable Accounting Services

At Number Solutions, we are dedicated to providing responsive and reliable accounting services specifically tailored for sole traders. We understand the importance of fast, efficient, and dependable support, ensuring you’re always informed about your financial status and never left in the dark.

Expertise Across Multiple Industries

With expertise across various industries, our experienced team knows how to address the unique challenges faced by sole traders. Whether you’re in retail, health care, education, trades, construction, or any other field, we bring industry-specific insights to your financial strategy, helping you stay aligned with your business goals.

Your Trusted Financial Partner

When you choose Number Solutions, you’re not just hiring an accountant—you’re partnering with a financial expert who is fully invested in your success. From tax planning to financial reporting, we provide personalised solutions that empower your business to thrive in South West Sydney, NSW.

How a Professional Sole Trader Accountant Can Help You

Managing finances as a sole trader goes beyond just balancing the books—it’s about having a strategic partner to support your business goals. At Number Solutions, we know the unique challenges you face and offer expertise tailored to your needs.

Expert Financial Insight: A skilled sole trader accountant provides valuable financial advice, helping you make smart decisions about investments, growth opportunities, and overall profitability.

Strategic Tax Planning: They create effective tax strategies, ensuring you benefit from all available deductions and credits while keeping you compliant with tax laws, helping you minimise tax liabilities.

Accurate Financial Records: Keeping your financial records precise and organised is crucial. An accountant ensures everything is up-to-date, making day-to-day operations smoother and supporting informed future planning.

Enhanced Financial Efficiency: By streamlining your financial processes and identifying cost-saving opportunities, a professional accountant improves your overall financial efficiency, helping you manage your resources better.

Business Growth Guidance: As your business grows, an accountant provides insights into financial performance, helping you pinpoint areas for improvement and plan strategically for future success.

Core Services We Provide for Sole Trader

Partnering with a skilled sole trader accountant offers you a range of essential services designed to keep your business on track and compliant. Here are some key services that a sole trader accountant can provide:

#1. Tax Return Preparation and Lodgment

Our accountant will ensure your tax returns are handled with precision and timeliness. Here’s what we will do:

- Accurate Preparation: Carefully prepare your tax returns, ensuring all income and expenses are correctly reported.

- Maximise Deductions: Identify and apply all eligible deductions to reduce your taxable income.

- Timely Submission: File your tax returns on time to avoid late fees and penalties.

- Error Minimisation: Review all financial details thoroughly to prevent mistakes that could lead to issues with the tax authorities.

- Paperwork Handling: Manage all necessary paperwork and communication with the tax office for a smooth process.

Having a professional handle your tax return preparation not only ensures accuracy but also gives you peace of mind knowing everything is done right. With their expertise, you can focus on running your business while they take care of the tax details.

#2. BAS and IAS Preparation and Lodgment

Managing your GST and PAYG obligations effectively is crucial. We will:

- Prepare BAS and IAS: Accurately complete your Business Activity Statements and Instalment Activity Statements.

- Ensure Accuracy: Double-check all figures to ensure your statements are correct and comply with current tax laws.

- Timely Lodgment: Lodge your statements on time to prevent any compliance issues or late fees.

- Handle GST and PAYG: Manage calculations for GST and PAYG withholding, ensuring correct reporting.

- Compliance Check: Verify that all required information is included and accurately reflects your business activities.

Efficient BAS and IAS preparation keeps your business compliant with tax regulations and avoids costly penalties. Relying on an accountant ensures that these critical tasks are managed correctly, so you can concentrate on growing your business.

#3. Bookkeeping Services

Proper bookkeeping keeps your financial records in order. We will:

- Record Transactions: Maintain detailed records of all business transactions, including sales, purchases, and expenses.

- Reconcile Accounts: Regularly reconcile bank statements and financial records to ensure accuracy.

- Maintain Records: Keep up-to-date and organised financial records that are crucial for tax reporting and business analysis.

- Track Financial Health: Provide insights into your cash flow and financial position through regular updates.

- Prepare for Tax: Ensure your bookkeeping is aligned with tax requirements, making tax return preparation easier.

Reliable bookkeeping is the backbone of effective financial management. By entrusting this task to your accountant, you ensure that your records are accurate and up-to-date, paving the way for better financial decisions and smoother tax processes.

#4. Financial Reporting and Analysis

Understanding your financial performance is key to strategic planning. Here’s we will help:

- Prepare Financial Reports: Generate detailed financial statements, including profit and loss statements, balance sheets, and cash flow statements.

- Analyse Performance: Offer insights into your business’s profitability, expenses, and financial trends.

- Evaluate Trends: Identify patterns in your financial data to help you understand your business’s performance over time.

- Support Decision-Making: Provide recommendations based on financial analysis to guide your strategic decisions.

- Growth Planning: Use financial reports to help you plan for future growth and manage resources effectively.

Comprehensive financial reporting and analysis are essential for making informed business decisions. With your accountant’s expert insights, you’ll gain a clear understanding of your financial health and be better equipped to drive your business forward.

By leveraging these core services, our experienced sole trader accountant helps you manage your finances with confidence and precision, allowing you to focus on growing your business.

Additional Services Tailored for Sole Traders

While basic accounting is essential, a sole trader accountant offers extra services that cater to your unique needs. These services ensure that your business runs smoothly and supports your long-term goals.

Cash Flow Management and Forecasting

Effective cash flow management is vital for the ongoing health of your business. Our accountant plays a key role in this by:

- Monitoring Cash Flow: Regularly reviewing your cash flow helps keep track of all incoming and outgoing funds, ensuring you’re aware of your financial position at all times.

- Planning for Expenses: Assisting with forecasting future expenses and setting aside funds in advance, helping you avoid financial strain during peak periods or unforeseen costs.

- Managing Cash Reserves: Developing strategies to maintain sufficient cash reserves, so you’re prepared for unexpected expenses and can seize new opportunities when they arise.

With expert cash flow management, you can stay ahead of financial challenges and keep your business running smoothly.

Strategic Financial Advice

Strategic financial advice is crucial for making informed decisions that drive your business forward. Our accountant provides invaluable support through:

- Expansion Planning: Offering guidance on how to effectively expand your business, including budgeting for new projects and assessing their financial impact.

- Investment Decisions: Providing expert advice on investing in new equipment, technology, or other assets, helping evaluate potential returns and alignment with your business strategy.

- Long-term Financial Goals: Assisting in planning for future financial needs, such as retirement or large capital investments, with strategies tailored to your business’s objectives.

By leveraging strategic financial advice, you can make confident decisions that align with your long-term goals and drive business growth.

Assistance with Business and Personal Finance Separation

Keeping business and personal finances separate is essential for streamlined management and compliance. We can helps by:

- Setting Up Separate Accounts: Establishing distinct bank accounts for business and personal use to simplify accounting and avoid the risk of mixing funds.

- Streamlining Record-Keeping: Implementing systems for accurate record-keeping of both business and personal transactions, reducing confusion and ensuring tax compliance.

- Managing Expenses: Assisting in setting up processes for categorising and tracking business expenses separately from personal ones, making financial management more efficient.

Maintaining clear boundaries between your business and personal finances makes managing both easier and helps ensure accurate financial reporting.

Other Services

With a cause-focused approach and belief in people, Number Solutions Tax and Accounting offers specialised accounting services for not-for-profit organisations. Their leadership team is fully committed to the success of their clients, providing exceptional financial, accounting, and consulting services.

Navigating tax regulations can be complex. We offer comprehensive tax compliance services for businesses, trusts, and SMSFs, ensuring you meet all your obligations with ease.

Starting a business can be overwhelming. From coming up with a business plan to reaching out to investors for funding to verifying compliance with state requirements, it takes a lot of steps to reach your entrepreneurial goals.

In the world of finance and professional services, trust is paramount. Clients trust professionals like solicitors, accountants, conveyancers and real estate agents to manage their funds with integrity and responsibility.

Managing a self-managed super fund requires expertise. Our SMSF accounting services cover everything from audits to compliance, giving you peace of mind.

Why Choose Us as Your Sole Trader Accountant

When you bring a sole trader accountant into your business, you’re not just adding a numbers expert—you’re gaining a valuable partner who can make a real difference.

- Improved Financial Management and Decision-Making: With an expert handling your finances, you can make better business decisions based on accurate, up-to-date information.

- Enhanced Compliance with Tax Regulations: Tax laws are constantly changing, and it can be hard to keep up. Our accountant will ensure you’re always compliant, reducing the risk of fines or audits.

- Time-Saving and Reduced Stress: Managing your accounts can be time-consuming and stressful. With an accountant on your team, you’ll have more time to focus on growing your business and less time worrying about the books.

Partnering with a sole trader accountant helps streamline your financial tasks, so you can concentrate on taking your business to the next level.

- We Create Value: Our deep industry knowledge and experience enable us to make a tangible difference in your business.

- We Listen and Collaborate: We work closely with you to develop the most effective financial strategies tailored to your needs.

- We Care About Your Success: We are genuinely invested in your financial success and are committed to helping you achieve it.

- We Offer Consistency: Our high standards across all services ensure your business remains in capable hands.

Experience our exceptional accounting and financial advisory services across South West Sydney and surrounding areas. Let us help you achieve financial success today.

Feel free to contact us through our website or call us at 02 9174 5327 for any queries. We’re here to assist you.

Our Commitment to Excellence

At our firm, we’re not just accountants—we’re dedicated partners in your success. We offer tailored accounting services specifically designed for sole traders, taking the time to understand your unique business needs, goals, and challenges. Our aim is to build lasting relationships with our clients, providing expert advice and support that helps your business thrive year after year.

We prioritise your success with personalised solutions and a commitment to high-quality service. For financial advice that makes a real difference, trust us to support your business every step of the way. Your growth is our mission, and we’re here to ensure you achieve it.

FAQ

Q: Does a sole trader need an accountant?

A: While not mandatory, having an accountant is highly beneficial for a sole trader. They help manage your finances, ensure tax compliance, and offer strategic advice, saving you time and reducing stress.

Q: What is accounting for a sole trader?

A: Accounting for a sole trader involves tracking income, expenses, and profits. It includes preparing financial statements and ensuring tax compliance, which helps in making informed business decisions.

Q: Can you hire someone as a sole trader?

A: Yes, as a sole trader, you can hire employees. You’ll need to manage payroll, handle taxes, and comply with employment laws.

Q: How to pay an employee as a sole trader?

A: To pay an employee, set up a payroll system to handle wages, taxes, and superannuation. Ensure you provide payslips and maintain accurate records.

Q: Are sole traders unable to employ people?

A: No, sole traders can employ people. You’ll need to follow proper payroll procedures and legal requirements for managing employees.