» Accounting » Small Business Accountant & Tax Agent

Trusted Small Business Accountant & Tax Agent

Rely on our trusted small business accountant and tax agent services to streamline your finances. We provide expert solutions tailored to help your business grow and thrive.

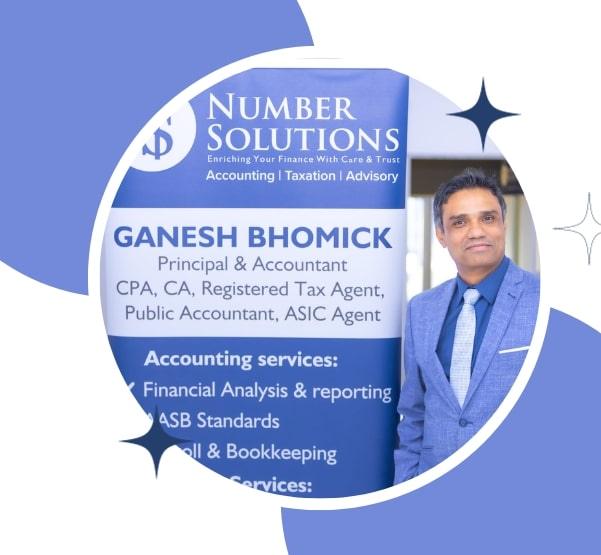

One of the key features of the Number solutions is their experienced and certified team of professionals.

The ability of the Number solutions is to provide customized solutions for each client's unique business needs.

BEST TAX SERVICES

Accountant & Tax Agent for Small Business

Achieve Financial Success with Our Expert Tax Services for Small Businesses.

Navigating the financial landscape of running a small business in Sydney or NSW areas can be challenging. From taxes to compliance, getting the right help is crucial. At Number Solutions, we are your go-to choice for comprehensive tax and accounting services tailored specifically to small businesses.

Beyond tax returns and compliance, we offer strategic business advisory, registration services, and ongoing financial management. At Number Solutions, we’re committed to ensuring your business thrives with the best financial guidance and support.

❓ Are You Struggling with Accounting and taxation for your Small Business?

How We Help Small Business Owners with Taxation & Accounting Services

At Number Solutions, we offer a range of specialized tax services to meet the unique needs of small business owners. Here’s how we can help:

- Tax Return Preparation: We handle the entire tax return process, ensuring accuracy and timely lodgement, so you can meet all ATO requirements without stress.

- Tax Planning & Advisory: Our tax agents provide proactive tax planning strategies, helping you minimize tax liabilities and take advantage of any available deductions.

- BAS Lodgement: We manage your Business Activity Statements (BAS) with precision, ensuring compliance with GST reporting and avoiding any late penalties.

- Tax Compliance: We keep your business compliant with all current tax laws, handling PAYG, GST, and other tax obligations, so you stay on top of your responsibilities.

- ATO Liaison: If any issues arise with the Australian Tax Office (ATO), we represent you, handling audits, inquiries, and disputes to protect your business interests.

- Small Business Tax Concessions: We help you identify and apply for tax concessions that are available to small businesses, reducing your overall tax burden.

- Bookkeeping: We provide comprehensive bookkeeping services, keeping your financial records organized, accurate, and up to date, allowing you to focus on running your business.

- Payroll Management: Our team ensures smooth payroll processing, managing employee wages, superannuation, and tax obligations, so you can avoid errors and late penalties.

- Cash Flow Forecasting: We help you track and forecast cash flow, ensuring that your business stays financially healthy and prepared for future growth.

- Financial Reporting: We generate detailed financial reports, giving you clear insights into your business’s performance and helping you make informed decisions.

Budgeting & Forecasting: We assist with creating effective budgets and financial forecasts, allowing you to plan for future growth and manage expenses more effectively.

With Number Solutions, you’ll receive expert taxation and accounting support tailored to your business, ensuring that you stay compliant, minimize tax liabilities, and maximise your returns.

Our Services for Small Businesses

We handle all aspects of your business tax preparation, from compiling necessary documents to identifying deductions that reduce your tax liability. Our team ensures that your tax returns are accurate, on time.

Navigating Business Activity Statements (BAS) and Goods and Services Tax (GST) requirements can be tricky. We take the pressure off by managing your BAS and GST submissions, ensuring everything is filed correctly and on schedule.

Payroll Services

Managing payroll can be a headache for small business owners. Our streamlined payroll services ensure that your employees are paid correctly and on time, with all superannuation and tax obligations handled efficiently.

Financial Reporting

Understanding your business’s financial health is essential for making smart decisions. We provide clear, detailed financial reports that give you a complete view of your business’s performance.

Business Advisory

Our strategic advice supports you in improving operational efficiency, planning for growth, and making well-informed business decisions.

Industries We Serve

At Number Solutions, we’re proud to support a wide variety of industries across Sydney and throughout NSW, offering tailored tax and accounting services that meet the unique needs of each business.

Tradespeople: Whether you’re a builder, plumber, or electrician, we understand the financial complexities that come with running a trade business. Our accounting services ensure smooth cash flow and compliance with tax regulations.

Healthcare: From doctors and dentists to allied health professionals, we provide specialized accounting solutions that simplify financial management, allowing you to focus on patient care.

Education: We offer tailored accounting and tax services to educational institutions, helping you manage payroll, tax obligations, and funding compliance.

Professional Services: Whether you’re an accountant, lawyer, or consultant, we assist with tax planning, reporting, and financial management, so you can focus on providing expert advice to your clients.

Restaurants and Hospitality: Whether you own a café, restaurant, or hotel, we help you manage bookkeeping, payroll, and GST, ensuring your business runs smoothly.

Construction: We work with builders, contractors, and construction firms to streamline invoicing, payments, and tax reporting, making your financial management stress-free.

No matter your industry, Number Solutions has the expertise and experience to help your business thrive. We understand the unique challenges of each sector and offer solutions designed to simplify your financial operations and boost profitability.

Why Choose Us For Tax & Accounting Service

At Number Solutions, we’re more than just accountants—we’re your partners in business growth. Here’s why choosing us makes all the difference:

- Expert Knowledge: With in-depth knowledge of the local tax landscape, our experienced team provides accurate and up-to-date advice that’s tailored specifically for small businesses in Sydney. We understand the ins and outs of tax compliance and can help you make the most of deductions, credits, and incentives available to your business.

- Tailored Solutions: We know that every business is unique, and a one-size-fits-all approach simply doesn’t work. At Number Solutions, we take the time to understand your specific challenges and goals, allowing us to create tailored tax strategies that suit your business.

- Affordable Rates: High-quality tax advice shouldn’t come with a high price tag. That’s why we offer competitive pricing that fits within your budget, ensuring you get the expert support you need without breaking the bank. Our goal is to provide great value that helps your business succeed financially.

- Ongoing Support: We don’t just disappear after the tax return is lodged. Whether it’s a quick question in the middle of the year or full support come tax time, our team is always here to help. At Number Solutions, we pride ourselves on being accessible and responsive to your needs all year round, ensuring your business stays on track.

- A Trusted Partner in Your Success: Choosing Number Solutions means partnering with a team that genuinely cares about your business’s growth and success. We bring years of experience, practical advice, and a hands-on approach to ensure your financials are in top shape, so you can focus on what you do best—running your business.

We Guarantee

- We deliver end-to-end services for all your property tax needs.

- We’re committed to your success.

- Our aim to improve financial position with measurable results.

- Every decision we make is centred on saving you both.

Our values, Your growth

- Care

- Respect

- Holistic approach

- Partnership

- Trust

- Cutting edge solutions

Experience the difference with Number Solutions today. Let’s help you navigate your tax and accounting needs with ease. Feel free to reach out to us at 02 9174 5327 or email us at info@numbersolutions.com.au for a chat about how we can support your business!

FAQ

Q: Do I need an accountant or a tax agent?

Ans: It depends on your financial situation. If your income is straightforward, you may manage on your own, but as your financial circumstances become more complex, consulting a registered accountant or tax agent is highly recommended. You might benefit from professional help if you have multiple sources of income, work several jobs, or have other factors that complicate your tax return. An accountant or tax agent can ensure accuracy and help you maximize deductions while staying compliant with tax laws.

Q. What is the tax rate for small businesses in Australia?

Ans: The standard company tax rate is 30%, but many small businesses qualify for a lower rate of 25%. To be eligible for this reduced rate, your business must be classified as a base rate entity. A base rate entity is a company with an aggregated turnover of less than $50 million. If your business meets this criterion, you can benefit from the lower tax rate, helping you retain more of your profits.

Q. What is the difference between a chartered accountant and a tax agent?

Ans: A tax agent focuses on ensuring your compliance with tax laws, providing advice when needed, lodging your tax returns, and representing you with the tax authorities. Their primary role is to keep your business in line with tax regulations. A chartered accountant, however, takes a broader approach as a financial strategist. They offer comprehensive financial advice, assist with budgeting, forecasting, and long-term planning, helping you optimize your overall business performance beyond just tax compliance.

Q. Do I need an accountant for a company tax return?

Ans: You have the option to lodge your company tax return directly with the ATO, or you can choose to work with a registered tax accountant. While you can handle it on your own, using an accountant ensures accuracy, maximizes potential deductions, and helps you navigate complex tax rules. An accountant can also provide expert advice and reduce the risk of errors, which could result in penalties.

Other locations we serve:

Liverpool, Bankstown, Canterbury, Camden, Fairfield, Blacktown, Campsie, Carlton, Merrylands