- home

- Best Rated Bookkeeper in Carlton

Best Rated Bookkeeper in Carlton

Empowering Carlton’s Businesses with Expert Bookkeeping Services—Keep Your Finances Simple, Clear, and Stress-Free.

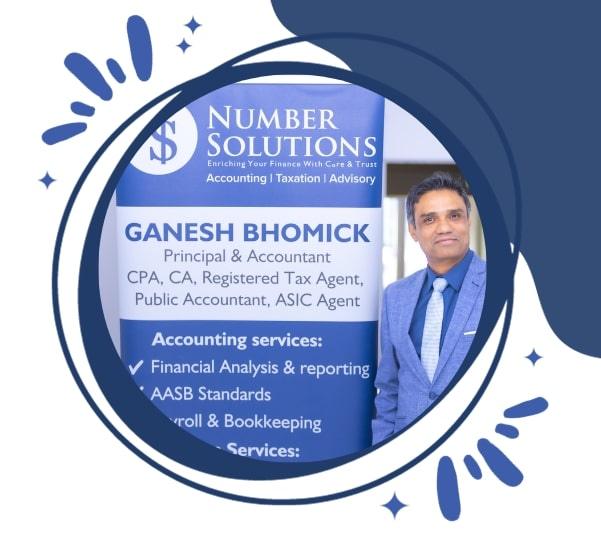

One of the key features of the Number solutions is their experienced and certified team of professionals.

The ability of the Number solutions is to provide customized solutions for each client's unique business needs.

BEST TAX SERVICES

Best Bookkeeper in Carlton, NSW

At Number Solutions, we’re here to be the best bookkeeper for your business in Carlton. We offer top-quality bookkeeping services designed to meet the unique needs of local businesses. Our team takes the time to understand your specific financial challenges and works closely with you to provide tailored solutions.

With years of experience, our skilled bookkeepers handle everything from everyday bookkeeping tasks to complex financial reports and payroll. We know the Carlton market well, so we can offer advice and services that fit perfectly with your business needs.

Choosing Number Solutions means you get more than just accurate bookkeeping. You get a local team committed to helping your business succeed. We’re dedicated to making your financial management simple and stress-free, so you can focus on growing your business.

Are You Struggling with Bookkeeping in Carlton?

Reliable and Affordable Bookkeeping Services

At Number Solutions, we’re dedicated to providing swift, straightforward, and cost-effective bookkeeping services for individuals and businesses across Carlton. Whether you need help with daily financial tracking, BAS preparation, or payroll management, our expert team is here to assist.

When you get in touch with us, you’ll work directly with one of our experienced bookkeepers who will address all your concerns and offer guidance tailored to simplify your financial processes.

Discover how Number Solutions can make your bookkeeping easier. Call us today or contact us online for more information.

Comprehensive Bookkeeping for Businesses

At Number Solutions, we offer a full range of bookkeeping services designed to meet the needs of businesses across various industries in Carlton. From sole traders to established businesses, we provide expert support to ensure your financial records are accurate and compliant.

No task is too big or too small for our skilled bookkeepers. We assist with everything from setting up efficient bookkeeping systems to ongoing support, helping you manage your finances smoothly and efficiently. If you need reliable bookkeeping services in Carlton, Number Solutions is here for you.

Number Solutions – Your Trusted Bookkeeping Partner in Carlton

When you choose to work with us, you’ll have a dedicated bookkeeper focused on your unique needs. Whether you require regular bookkeeping or specific financial insights, our team is committed to delivering exceptional service and support.

How a Professional Bookkeeper Can Help You

Managing the financial side of your business isn’t just about keeping track of numbers—it’s about creating a solid foundation for growth and success. Hiring a professional bookkeeper brings more than just accuracy; it brings strategic advantages that can significantly enhance your business operations.

Expert Financial Organisation: A professional bookkeeper ensures your financial records are meticulously organised and up-to-date. This helps prevent errors and provides you with a clear picture of your financial health, allowing you to make informed decisions with confidence. Accurate records also simplify tasks like financial reporting and tax filing, saving you valuable time and reducing stress.

Maximise Deductions and Avoid Mistakes: Bookkeepers have a keen eye for identifying eligible deductions and credits that you might overlook. They help ensure you’re taking full advantage of available tax benefits while staying compliant with regulations. By catching potential errors before they become costly mistakes, they help you avoid penalties and fines.

Streamlined Financial Processes: Efficient financial management is crucial for any business. A professional bookkeeper streamlines your financial processes, from invoicing and expense tracking to payroll management. They implement effective systems that save you time and effort, allowing you to focus on what matters most—growing your business.

Strategic Financial Insights: Beyond day-to-day bookkeeping, a seasoned professional offers valuable insights into your financial trends and performance. They can guide budgeting, cash flow management, and financial planning, helping you to make strategic decisions that drive your business forward.

Peace of Mind: Knowing that your finances are in capable hands provides peace of mind. A professional bookkeeper not only manages your records but also acts as a reliable advisor, ready to answer your questions and offer guidance. This support ensures you’re always informed and prepared for financial challenges.

Regulatory Compliance: Staying compliant with financial regulations and tax laws is crucial to avoid penalties. A professional bookkeeper keeps up with the latest changes in regulations, ensuring your business adheres to all legal requirements. This proactive approach mitigates risks and keeps your operations smooth.

A professional bookkeeper does more than just keep your books in order—they enhance your business’s financial efficiency, provide strategic insights, and ensure compliance with regulations. At Number Solutions, we’re dedicated to offering top-notch bookkeeping services that help you achieve financial clarity and success. Reach out to us today to discover how our expertise can benefit your business.

Our Services

Keeping your day-to-day transactions in order is crucial for smooth business operations. Our general bookkeeping services cover everything from recording income and expenses to reconciling bank statements. We ensure that all your financial data is accurate and up to date, giving you peace of mind and a clear view of your financial health.

Business Activity Statements (BAS) can be complex and time-consuming. Our team handles BAS preparation with precision, ensuring compliance with ATO requirements. We take care of the calculations, lodgements, and record-keeping, so you can focus on running your business without worrying about tax obligations.

Payroll Management

Managing payroll can be a daunting task, especially with varying employee entitlements and tax rates. Our payroll management services include calculating wages, processing pay runs, managing superannuation contributions, and ensuring compliance with employment laws. We make sure your staff are paid accurately and on time, every time.

Financial Reporting

Regular financial reporting is essential for making informed business decisions. We provide detailed financial reports that offer insights into your business performance. From profit and loss statements to balance sheets and cash flow statements, our reports help you track your financial progress and plan for the future.

Complex Financial Planning

For businesses with more intricate financial needs, we offer expert support in complex financial planning. This includes budgeting, forecasting, and financial analysis tailored to your specific business goals. Our team helps you develop strategies to manage your finances effectively and achieve long-term success.

What We Do for Individuals

At Number Solutions, we offer a range of essential bookkeeping services designed to support individuals in managing their finances effectively. Here’s how we can assist you:

- Personal Tax Preparation: Our expert team ensures accurate preparation and timely filing of your personal tax returns. We aim to minimise your tax liabilities by identifying eligible deductions and credits, so you keep more of your hard-earned money.

- Comprehensive Budgeting Assistance: We help you create and maintain a personalised budget that aligns with your financial goals. By tracking your income and expenses, we provide insights to help you manage your finances and make informed decisions.

- Financial Future Planning: We offer guidance on long-term financial planning, including savings strategies, retirement planning, and investment advice. Our goal is to help you build a solid financial foundation for the future.

- Debt Management and Advice: We support you in developing a plan to manage and reduce debt. From consolidating loans to negotiating with creditors, we aim to improve your financial stability and credit standing.

For Sole Traders and Businesses

At Number Solutions, we offer a range of tailored bookkeeping services designed to support your unique needs, help you stay compliant, and foster business growth. Whether you’re just starting or looking to streamline your operations, our team is here to guide you every step of the way.

- Customised Bookkeeping Systems: Setting up the right accounting system is crucial for effective financial management. We help you choose and implement the best bookkeeping solutions for your business, ensuring that your financial data is organised, accessible, and aligned with your business goals.

- Ongoing Support and Advice: Running a business involves continuous financial management. We provide ongoing support to keep your books in order, address any financial concerns, and offer strategic advice to help you make informed decisions and adapt to changing circumstances.

- Cash Flow Management: Effective cash flow management is essential for business stability and growth. We help you monitor and manage your cash flow, ensuring you have the funds needed to cover expenses, invest in opportunities, and sustain your operations.

- Compliance and Reporting: Staying compliant with regulations is a top priority for every business. Our services include preparing and filing necessary reports and ensuring adherence to financial regulations, so you can avoid penalties and focus on your business.

- Financial Planning and Strategy: We offer expert financial planning and strategic advice to help you set and achieve your business goals. From budgeting and forecasting to financial analysis, we provide the insights you need to plan for the future and drive growth.

- ABN Registration and Business Set-Up: Starting a new venture? We assist with ABN registration and guide you through the process of setting up your business. Our support ensures a smooth start, allowing you to focus on building your business.

- Payroll Management: Managing payroll efficiently is crucial for maintaining employee satisfaction and compliance. We handle all aspects of payroll, including wage calculations, superannuation, and tax withholdings, ensuring accuracy and timely payments.

- Business Health Check: Regular assessments of your business’s financial health help identify areas for improvement. Our comprehensive business health checks provide valuable insights and recommendations to enhance your operations and profitability.

- Business Valuations: Accurate business valuations are essential for making informed decisions, whether you’re planning a sale, acquisition, or investment. Our valuation services offer a clear and precise assessment of your business’s worth.

- Independent Reviews and Appraisals: Gain objective insights into your business’s performance through our independent reviews and appraisals. These evaluations help you understand your strengths and areas for improvement, guiding your strategic decisions.

Why Choose Us as Your Bookkeeper in Carlton

At Number Solutions, your business success is our mission. We offer value-centred bookkeeping services that help you maximise your profitability while staying compliant with all financial regulations. When you choose us, you’re choosing a partner committed to making your business thrive.

- We create value and make a real difference to your business using our extensive industry knowledge and experience.

- We listen and collaborate with you to provide the most effective bookkeeping solutions tailored to your needs.

- We genuinely care about your business, ensuring that every financial decision supports your growth.

- We work with you to boost your profits at a price that fits your budget.

- We maintain a high level of consistency and accuracy in our services, so your business always runs smoothly.

We Guarantee

- We will provide a holistic and comprehensive bookkeeping service.

- We will exceed your expectations with our proactive approach.

- We will deliver positive results that enhance your business operations.

- We will simplify complex financial tasks, saving you time and money.

- We will manage your finances with care, ensuring nothing is overlooked.

Our values, Your growth

- Care

- Respect

- Holistic approach

- Partnership

- Trust

- Cutting edge solutions

Experience our exceptional bookkeeping services across Carlton and beyond. Let us help you unlock your financial potential with Number Solutions today.

Feel free to reach out to us through our website or give us a call at (02 9174 5327) for any questions you may have. We’re here to help.

Our Commitment to Excellence

At Number Solutions, we don’t just provide services—we build partnerships. With a strong focus on delivering top-notch bookkeeping solutions, we stay ahead of industry trends and ATO regulations to ensure your business remains compliant and successful.

Our team is committed to ongoing training and development, which allows us to offer the highest quality service to our clients in Carlton. We believe that your success is our success, and we strive to exceed expectations by providing reliable, responsive, and tailored support.

Trust Number Solutions to be your dedicated partner in achieving financial excellence.

FAQ

Q: Is it worth getting a bookkeeper in Carlton?

Ans: Yes, a bookkeeper can save you time, ensure accuracy, and help you stay on top of financial obligations.

Q: What can an accountant do that a bookkeeper cannot?

Ans: Accountants can provide tax advice, financial analysis, and prepare complex financial statements, which bookkeepers cannot.

Q: Is a bookkeeper better than an accountant?

Ans: Bookkeepers and accountants serve different roles; bookkeepers manage day-to-day finances, while accountants handle broader financial planning and tax matters.

Q: Do I need both a bookkeeper and an accountant for my business in Carlton?

Ans: Many businesses benefit from having both to ensure thorough financial management and compliance. Ultimately, the decision is up to you.

Q: What is a bookkeeper not allowed to do?

Ans: Bookkeepers are not permitted to provide tax advice or conduct audits, tasks that require a licensed accountant.

Other locations we serve:

Liverpool, Bankstown, Canterbury, Camden, Campbelltown, Blacktown, Campsie, Carlton, Merrylands