» Not-for-Profit » Determining the Applicability of AASB 15 or AASB 1058 under the New Income Recognition Model

Determining the Applicability of AASB 15 or AASB 1058 under the New Income Recognition Model

AASB 1058 titled “Income of Not-for-profit Entities,” and AASB 15 titled “Revenue from Contracts with

Customers”

AASB 1058 became applicable for annual reporting periods beginning on or after 1 January 2019.

Despite its focus on income, AASB 1058 does not alter the Australian Charities and Not-for-profits

Commission’s (ACNC) existing interpretation of revenue and income. The determination of a charity’s

size under the ACNC Act involves calculating revenue in accordance with relevant accounting

standards, including AASB 1058.

AASB 1058 allows the recognition of both revenue and other income, especially from a charity’s

ordinary activities. The income recognition model introduced by AASB 1058 prompts a consideration

of whether to apply AASB 15 or AASB 1058.

Charities may acquire assets, including cash, at a value significantly below market or even without any

consideration, such as grants and donations. If there are no enforceable, identifiable, and measurable

obligations tied to the receipt of the asset, AASB 1058 dictates that income (e.g., donations) is

recognized after the asset is accounted for under the relevant accounting standard (e.g., AASB 9

Financial Instruments), particularly when no conditions are attached.

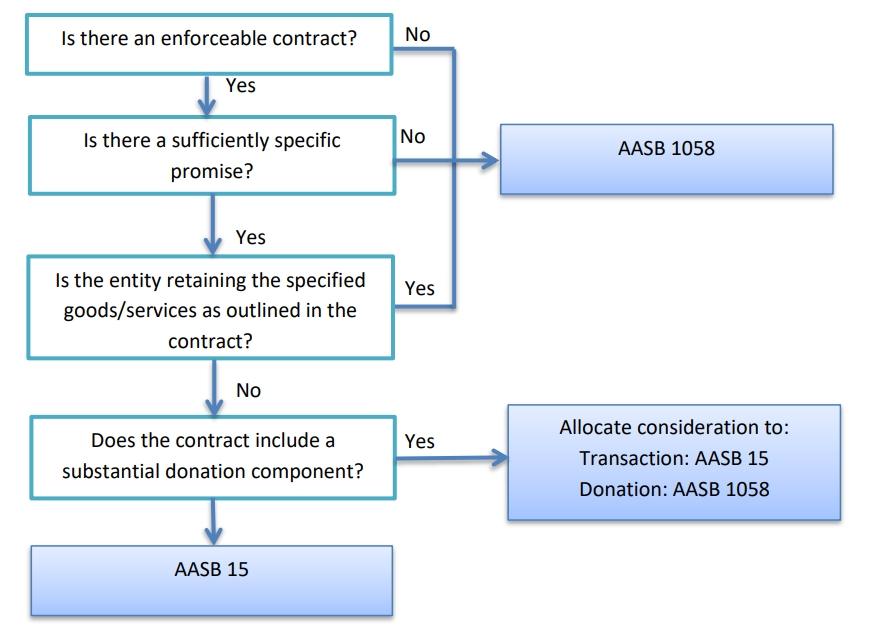

In contrast, if a charity is bound by a contract specifying specific obligations for receiving an asset,

consideration must be given to whether AASB 15 applies to the entire transaction or a portion of it.

The determination hinges on whether the contract is enforceable and contains sufficiently specific

performance obligations, making it within the scope of AASB 15. Charities are required to assess

revenue contracts to ascertain whether they fall under the purview of AASB 15, AASB 1058, or both,

taking into account enforceability and the specificity of performance obligations.

What is the Appropriate Accounting Standard to Apply?

| Not-for-Profit AGM Requirements in Australia | Key Points |

|---|---|

| 1. Purpose of the AGM | Provides a comprehensive report on the charity’s activities and finances from the previous year. Enables members to ask questions and participate in electing governing body members. |

| 2. Timing and Frequency | Mandated annually by state Acts. Specific timelines vary from state to state, requiring adherence to the set timeframe from the start of the organization’s financial year. |

| 3. Reporting Obligations | Detailed reports vary by state and organization size, typically including financial statements, a summary of activities, and plans for the future. |

| 4. Board Elections | While not mandatory in every state, it is generally recommended to elect a slate of board members during the AGM. Board positions may be decided in subsequent board meetings. |

| 5. Quorum and Proxies | Quorum, defined in the constitution, specifies the minimum number of members required for a valid decision. Proxies allow members to delegate voting power if permitted in the constitution. |

| 6. Technology Usage | New South Wales and Victoria allow technology use for AGMs. Other states permit technological aids if the constitution allows. Leverage email or efficient communication methods for notices. |

| 7. Documentation and Notices | Providing members with adequate notice and documentation is crucial. Follow constitution guidelines for notice periods, especially when proposing special resolutions. Leverage efficient communication. |

Seeking Expertise in AASB 1058 and AASB 15 Compliance:

Understanding and applying these standards can be challenging. If you are experiencing difficulties

in recognizing your income in accordance with AASB 1058 and AASB 15, Number Solutions Tax and

Accounting is here to assist. Our team has the expertise to guide you through these complex

standards, ensuring your compliance and financial reporting accuracy. Please contact us on 02 9174

5327 or info@numbersolutions.com.au for personalised assistance and to discuss how we can

support your specific needs.

Related Articles: