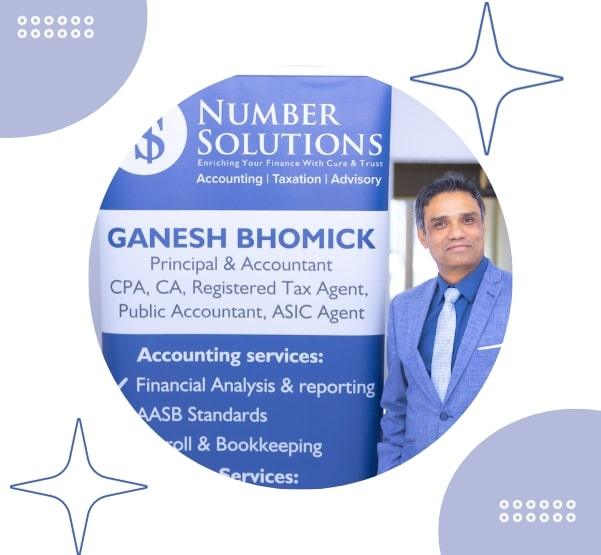

One of the key features of the Number solutions is their experienced and certified team of professionals.

The ability of the Number solutions is to provide customized solutions for each client's unique business needs.

BEST TAX SERVICES

Tax Accountant in Minto, NSW

At Number Solutions, we take pride in being the leading tax agent in Minto, NSW. Our dedicated team of experienced and certified professionals is committed to providing exceptional tax and accounting services tailored to meet the needs of the local community.

We understand the unique challenges faced by individuals and businesses in Minto. Our goal is to offer expert advice and practical solutions that make managing your finances simpler and more effective.

With a strong presence across South West Sydney, including Minto and nearby areas like Camden and Campbelltown, we bring our comprehensive financial expertise right to your doorstep. From business formation and registration to ongoing compliance and strategic tax planning, we cover it all.

At Number Solutions, our commitment extends beyond numbers. We aim to be your trusted partner, offering the professionalism and insight needed to help you achieve your financial goals and navigate the complexities of tax with ease.

❓Are You Struggling with Taxes and Accounting in the Minto area?

Reliable and Affordable Tax Services

If you’re grappling with tax issues or simply not satisfied with your current tax agent, we’re here to provide a solution. At Number Solutions, we pride ourselves on delivering quick, clear, and budget-friendly tax return and accounting services for both individuals and businesses in Minto. From straightforward tax returns to more complex financial matters, our team of experienced professionals is ready to assist you.

Reach out to us and connect with a knowledgeable tax expert who will address your concerns and offer personalised guidance to streamline your tax experience. Discover how we can simplify your tax process—give us a call or contact us online for more details.

Tailored Services for Small Business Needs

At Number Solutions, we offer a full suite of accounting, bookkeeping, and tax services designed to meet the needs of small businesses. We proudly serve a wide range of industries, including retail, hospitality, construction, and more. Whether you’re starting a new venture or managing an established business, our tax agents in Minto are here to provide expert support and advice at every stage of your business journey.

From initial setup and registration to growth strategies and business sales, no task is too big or small. If you’re searching for a reliable tax agent in Minto, Number Solutions is your go-to partner.

Number Solutions – Your Trusted Tax Agent in Minto

Choosing Number Solutions means working with a dedicated tax professional focused on your unique needs. Whether you need assistance with a basic tax return or detailed advice on tax strategies, our team is committed to delivering exceptional service. Experience the difference of working with your trusted tax experts in Minto and let us help you achieve your financial goals.

How a Professional Tax Agent Can Help You

Dealing with taxes involves more than just filling out forms—it’s about understanding complex regulations and making strategic decisions to benefit your financial future. At Number Solutions, our professional tax agents in Minto are dedicated to helping you navigate these complexities with ease and confidence.

Informed Tax Strategy: A professional tax agent offers valuable insights into current tax laws and trends, helping you make smart decisions about your finances. Whether you need advice on investment choices, planning for retirement, or managing your assets, our experts provide tailored guidance to optimise your tax situation and ensure you maximise potential savings.

Efficient Tax Planning: Effective tax planning is crucial for minimizing liabilities and taking full advantage of available tax benefits. Our tax agents excel at crafting strategic plans that align with your financial goals, ensuring you benefit from deductions, credits, and incentives while maintaining compliance with tax regulations.

Precise Financial Record-Keeping: Accurate and well-organised financial records are essential for smooth operations and sound decision-making. Our team ensures that your records are meticulously maintained, enabling you to keep track of your financial health and prepare for future planning with confidence.

Boosting Financial Efficiency: Streamlining your financial processes is key to improving overall efficiency. Our tax agents identify areas where you can save costs and manage resources more effectively, contributing to better financial management and enhanced business performance.

Guidance on Business Growth: As your business evolves, strategic advice from a professional tax agent can be invaluable. We offer insights into financial performance, help identify growth opportunities, and assist in developing plans that support your business objectives and foster sustainable expansion.

Regulatory Adherence: Staying compliant with tax laws is critical to avoid penalties and legal issues. Our experts stay updated with the latest regulations and ensure that your business adheres to all requirements, providing peace of mind and reducing the risk of complications.

With our commitment to detailed, strategic support and personalised service, we’re here to help you manage your taxes efficiently and effectively. Contact us today to learn how we can assist you in reaching your financial goals.

Our Services

Accounting is the backbone of any successful business. At Number Solutions, we understand the critical role that accurate and timely accounting plays in managing your finances. Our services include everything from routine bookkeeping and financial reporting to more complex accounting tasks. We ensure your records are up-to-date and compliant, so you can focus on growing your business with confidence.

Navigating the complexities of tax law can be challenging. Our tax experts are here to make the process as straightforward as possible. We offer comprehensive tax services, including tax planning, preparation, and compliance. Whether you’re an individual needing assistance with your annual tax return or a business seeking strategic tax advice, our team is equipped to handle all your tax-related needs and ensure you maximise your tax benefits while staying compliant.

Self-Managed Super Fund (SMSF)

A Self-Managed Super Fund (SMSF) offers a unique opportunity for greater control and flexibility over your retirement savings. Our SMSF services are designed to help you manage your fund efficiently, from setting up your SMSF and complying with regulations to handling investments and annual audits. Let us guide you through the complexities of SMSFs and help you make informed decisions to secure your financial future.

Business Formation, Registration, and Compliance

Starting a business involves many crucial steps, from drafting a business plan to registering your company and meeting regulatory requirements. At Number Solutions, we provide comprehensive support throughout this process. We assist with business registration, compliance with local laws, and setting up the necessary structures to ensure your new venture is on solid ground.

Business Advisory

Effective business management requires careful planning and strategic thinking. Our business advisory services are designed to support you in every aspect of running a successful business. Whether you need advice on growth strategies, operational improvements, or financial management, our experienced advisors are here to provide valuable insights and help you achieve your business goals.

What We Do for Individuals

- Personal Tax Returns: Our expert tax agents in Minto ensure your tax returns are meticulously prepared and filed on time. We focus on accuracy while seeking out every possible deduction, helping you minimise your tax liability and keep more of your hard-earned money.

- Tax Disputes and Investigations: If you’re facing a tax dispute or an investigation by the ATO, our team is here to support you. We navigate the complexities of these situations, working diligently to achieve fair resolutions and ensure compliance with all tax laws.

- Property Tax Advice: Owning property can introduce a range of tax considerations. Our specialists provide clear, informed advice on property-related taxes, whether you’re managing rental income or considering new investments. We help you understand your obligations and optimise your financial strategy for property ownership.

For Sole Traders and Businesses

- Tailored Tax Planning: Our tax planning services are designed to help you navigate the complexities of taxation while ensuring compliance and maximising tax savings. We craft strategies that align with your specific business needs to optimise your financial outcomes.

- Efficient Payroll and PAYE Management: Managing payroll and PAYE obligations can be time-consuming. Our reliable services ensure that your payroll is accurately calculated and submitted on time, keeping your business compliant and your employees satisfied.

- Seamless ABN Registration and Business Setup: Whether you’re starting fresh or expanding, we provide seamless ABN registration and comprehensive guidance to help you set up your business efficiently, ensuring that all the necessary steps are covered from the start.

- Strategic Business Property Tax Planning: For businesses with property investments, our experts offer strategic advice and tax planning to optimise your property-related tax strategies, helping you minimise liabilities and maximise returns.

- Accurate GST Lodgement: Staying compliant with GST regulations is crucial. Our team ensures that your GST lodgements are handled accurately and on time, reducing the risk of errors and penalties.

- Comprehensive Business Planning: We assist in crafting detailed business plans that clearly outline your goals, strategies, and pathways to success. Our plans are designed to be actionable, guiding you through each stage of growth.

- Business Growth and Expansion Strategies: Achieving growth requires strategic planning. Our expert advice and tailored strategies help fuel your business’s expansion, ensuring that you meet your goals and scale effectively.

- Thorough Business Health Check: Regularly assessing the health of your business is vital for sustained success. Our comprehensive health checks identify areas for improvement and provide actionable insights to strengthen your business.

- Accurate Business Valuations: Whether you’re considering selling, merging, or just curious about your business’s worth, our valuation services provide an accurate assessment, essential for informed decision-making.

- Objective Business Reviews and Appraisals: Gain valuable insights into your business’s performance with our independent reviews and appraisals. We provide a clear, objective analysis to help you understand where your business stands and how to improve it.

- Meticulous Bookkeeping Services: Keep your financial records accurate and up-to-date with our meticulous bookkeeping services. We ensure that every transaction is recorded properly, providing you with reliable data for better financial management.

Why Choose Us as Your Tax Agent in Minto?

With Number Solutions as your trusted tax agent in Minto, your financial success is our top priority. We are committed to providing value-driven solutions that not only meet your tax obligations but also enhance your overall financial health. Let us handle the complexities of taxation, so you can focus on what you do best.

- Creating Value: We use our industry expertise to enhance your financial well-being with strategies tailored to your needs.

- Listening to You: We closely understand your needs and goals to provide the best-fit solutions.

- Caring About Your Success: We’re committed to achieving the best outcomes for you at a fair price.

- Consistent Service: We deliver reliable, high-quality services to keep your financial operations smooth and efficient.

We Guarantee

- Comprehensive Service: We cover all aspects of your financial health, beyond basic tax compliance.

- Exceeding Expectations: We aim to simplify your financial life with results that go beyond what you expect.

- Simplified Processes: Our straightforward approach saves you time and reduces stress.

- Cost-Efficiency: We offer valuable services that save you both time and money.

Our values, Your growth

- Care

- Respect

- Holistic approach

- Partnership

- Trust

- Cutting edge solutions

Experience our exceptional tax services in Minto and throughout South West Sydney. Let us help you unlock your financial potential with Number Solutions today.

Feel free to contact us through our website or give us a call at (02 9174 5327) for any further queries. We’re here to assist you.

Our Commitment to Excellence

At Number Solutions, we’re more than just tax agents – we’re your trusted financial partners. We’re dedicated to providing tailored solutions that cater to the unique needs of individuals and businesses in Minto. With years of industry experience, our goal is to help you achieve financial success and peace of mind.

For high-quality, personalized tax advice that can elevate your financial future, trust Number Solutions. Your financial success is our top priority.

FAQ

Q: Is it worth paying a tax agent?

Ans: Yes, a tax agent can help you maximize deductions and ensure your taxes are done correctly, potentially saving you money.

Q: How much should a tax agent charge?

Ans: Fees typically range from $100 to $500, depending on the complexity of your tax return.

Q: What is the difference between a tax agent and a tax accountant?

Ans: A tax agent is registered with the TPB and can lodge returns; a tax accountant may not be registered but can still prepare taxes.

Q: How much do most accountants charge for taxes?

Ans: Most accountants charge between $150 and $400 for individual returns, with higher fees for business taxes.

Other locations we serve:

Liverpool, Bankstown, Canterbury, Camden, Campbelltown, Blacktown, Campsie, Carlton, Merrylands